清晨5:00起和黃昏18:00後的運動休閒時間,我習慣於住家附近的山區小路take the air,此時腦波頻率自然放慢,且自動啟動右腦機制,取代整日分析、算計甚至瘋狂的左腦。

健康的身心靈能夠長久完成更多、更好及更高級的工作,幫助造物者創造,使環境更有秩序,把地球改造成天堂。

所以,7月底以來的夏季,我在此後花園種植了200多棵的"五月雪",奇異恩典的很,竟然種活了100多棵,現在她們大約60公分高。

當放鬆的程度加深到a(阿爾法)層次時,腦波振盪頻率減低,我內心由外部層次轉變成( time shift)內部意識層次----潛意識或無意識,and God's always by my side.

右腦連上大智慧創造區,將自己更深遠的開放,並且交給另一面,我內心的電腦接上更大的電腦,我的超我或超智慧會聽到我的呼喚和需要,我的要求就實現了。

註:

1.這心靈家園的後花園有非常多的意境與境界,上面只是夏季中的10張照片;

2.照片中有騎越野腳踏車的是我4年前從中國上海回來後,為了提升心靈、左右腦平衡所做的晨間運動;

3.其他的是喜愛在此後花園中運動、休閒及追求寧靜的形形色色的人。

StockPreacher & StockPicker :

一、前言

股市競爭比戰場還激烈,要買什麼股票?要賣什麼股票?必須要有一一致性、完備性且是決定性的公設(postulate)或公理(axiom)做為股市戰場的作戰準則 --- 低買高賣。

二、股價低買高賣的準則

股價低於內在價值時就堅決分批買入,以實現“低買”作戰準則;反過來,股價遠高於內在價值時,就應該分批賣出股票,以實現“高賣”作戰準則。(確定你持股的股價比(P/X)在本blog表頭分配圖的哪一區間,及其臨界點)

三、買什麼股票的作戰準則

當股價 / 內在價值處於收歛,其趨近於臨界值域下限時是最佳的買入時價區域,也就是:d(P/V) → 0,且d(d(P/V)) > 0 ;

四、賣什麼股票的作戰準則

當股價 / 內在價值處於發散,其趨近於臨界值域上限時是最佳的賣出時價區域,也就是:d(P/V) → 0,且d(d(P/V)) < 0 ;

五、實戰之實證與情報

此實證與情報等情資已於MICS-Stock Picker表裡全盤托出,細心的價值投資作戰戰士,請自行察閱。

本文更詳盡的解析,請搜尋下表資料裡的電子書:恐慌與機會。

2008/8/27

The Road Never Taken / 最喜歡的放鬆之處

2008/8/23

China's GDP may have overvalued, and at least 2% overvalued / 中國公佈的GDP有高估的可能,且至少高估2%

China's growth rate of GDP, the first quarter last year was 11.1 %, in the second quarter was 11.5%, in the third quarter was 11.5 %, the fourth quarter was 11.4%, in the first quarter was 10.6 %. In July of last year , the United States began the global financial crisis seems to have no impact on China, it's very stable, China's as a developing country, it's economic growth performance is so stable, is very surprising, Even a developed country will have the so-called output volatility, the volatility in developing countries should be greater, but in China not see the data, there are two possibilities, one is the data with problems ,and another that it is a miracle, so it is perfect.

I can not believe the China's statistics. China's reform and opening up from 1978 to 2004, its annual GDP growth rate is an annual average of 9.3%, this is a very high figure, the analysis of this 9.3%, of which 2 % is from the employment growth, 3.2% from the physical capital investment, 0.2% from the education and human capital . By macro economic model to compare input and the output data, the increase of regression residuals of all elements of total factor productivity( TFP) in China ,is an annual average of 3.8 % during this period, this is a very high figure.

During the same period in East Asia (excluding China) in 1980 to 2003, GDP increased 6.1%, employment increased 2.4 %, the East Asian region no one-child restrictions, so labor is relatively high growth rate, a 2.2% in capital, 0.5 % in education, including Japan, South Korea, Singapore, Taiwan, Hong Kong and other major economies in East Asia during this period all factor productivity increased by only 0.9 percent, if consider economic development in East Asia earlier, in the view of 1960-1980 , All of the elements of productivity increased by only 1.2 %. This means that once created the economic miracle of the East Asian region, the TFP only about 1%, but China has 3.8 %, and the major increase of TFP came from the manufacturing sector.This figure is difficult to interpret and imagine.

So China's fundamentals are not sufficient to support its stock market to be up.

Market +price difference of the Olympic Games effects had been completed and gone in 2007 ! / 奧運正價位差行情在2007年就已走完!

I'd gotcha a more conservative attitude in China's economic development in the day after the Olympic Games.

China's economic is going to full of risks and challenges. In an optimistic boom, the most vulnerable investors always lose self-awareness and preparedness, and these investors are often to become the biggest victims of the economic crisis , so investors still have to take precautions.

The stock price is reflecting the industry company's future earnings and profits, the stock market is usually a leading indicator of the confidence index. Shanghai Stock Exchange in October last year from a high of 6,000 points now dropped below 2,500 points,has been dropping by half, which can sniff out some of China's economic prospects for clues.

China's stock market is more likely to keep the current situation in the short-medium-term future , as its fundamentals are not sufficient to support its stock market to be up.

Since 2007's fall, I have been detecting an "after-the-Olympic syndrome" is going to bring to China's economic "valley effect" as soon as I'd posted the follows:

Why'd Buffett cleared all China Petroleum during Oct. 2007 ?

There is a bear in U.S., isn't it?

你知道造成次級房貸風暴的"真正病因"是甚麼嗎?

US's been giving something up to pay for food !!!

2008/8/15

The glossy red dragon gave me a chance to raid it !! 中國跌勢"熊熊" 機遇伴我行

In stocks markets, there're always dog days in August or the fall. I regard an "after-the- Olympic syndromes" is going to bring "valley effects" of Pendulum movement in many markets. Dare you call, put them or do nothing?

Missions of Lee Li forward observation officer:

(First mission ): The second forward observation officer requires shooting : Azimuth: 2400, Distance: 7000, the Standard Deviation: 300, Target: the extreme point of the bull in rebounding , Armour-piercing bombing of the question to fire.

(Second mission): The second forward observation officer requires shooting : Azimuth: 1722, Distance: 102.5, Standard Deviation: 1, Target: 1722 rebound in the extreme point, the bombing of all the effectiveness to fire. (Note: the + effects of the land assets against inflation in Taiwan is gone; Current stock price of 1722 is more highter than those stocks of 2882,1301,2002 and 2330, maybe there're motives behind a task force for the non-rational control. Therefore, the price of 1722 is above NT$100 , is a good attacking target area for the forward observation officer to request to launch shooting .)

(Third mission ): Elongating front, observing and searching battlefield terrain and the enemys dynamic features. Since the fall 2007, I've been detecting " an after-the-Olympic syndrome" will bring to China's economic "valley effect" !

2008/8/8

Whispering in the Tanabata starring night sky / 七夕夜的星空夜語

獻給被打落凡間的 Angel Lotus,

因犯天條,平日牛郎和織女只能站在銀河的兩端,遙遙相望,只有到了每年農曆的七月七日的七夕夜,牛郎和織女才獲准相會一次,此時,成千上萬隻喜鵲飛來,在銀河上架起一座長長的鵲橋,讓牛郎織女再次團聚。

今夜星空燦爛,讓我們聽著凡間美妙的月光組曲,仰首聆聽天上的夜空星語,遙思眺望著億萬光年外的牛郎和織女相會於銀河鵲橋上!

現在按下面player一下,聆聽貝多芬的月光奏鳴曲。

另一曲是德布希的月光:

2008/8/7

對於行情的變化要採取彈性的因應對策

負價位差(虧損)的時候要當機立斷執行停損點機制;正價位差(賺錢)的時候要忍耐等待滿足點的到來:

一般人左腦大多屬正向思考,想在正價位差行情趨勢中賺到錢,且大多會訂定滿足點的如意算盤,但行情總是瞬息萬變的,尤其 更明顯地會隨著經濟和政治等重要變數而發生變化。有時隨著局勢的變化,所買的股票不得不見風轉舵馬上賣出,即使開始時已訂定了滿足點如意算盤,但是受到局 勢所迫,不得不賣出也是人之常情。故買賣股票必須經常因應局勢的變化,採取圓融的彈性態度。若在買進後股價卻下跌,就應該以非預期性的不利變數判斷,然後 再立即拋售,萬萬不能跟股價談戀愛,這才是確保不致大虧的不二法門......理性且確實地執行滿足點和停損點的機制。

2008/8/3

The U.S. unemployment rate should be as high as 10.3 % ! 台灣TFT-LCD, DRAM 等 一葉知秋!

今天要探討美國嚴重失業的實際狀況,此持續惡化的失業引發的產業、貿易關連,已帶給台灣電子IT等產業致命的一擊。

My algorithms :

【U.S.unemployment↑→ Consumer Real Income↓→Consumer purchasing power↓→Consumer Spending↓→ Companies Orders↓】→【Stock Price↓】←【Companies Real Revenue↓ ←Companies Real Profit(EPS)↓】;

Red : Leading Indexes, Black : Lagging Indexes ;

US's GDP and Jobs came up short of expectations, and the general feeling is that now the stimulus is gone, what comes next and to be? and then Taiwan ?

***美國政府最新(2008/07/31)資訊:

(a)The Commerce Department said that GDP growth rose 1.9% in the second quarter, lower than the 2.3% expected from economists surveyed by MarketWatch. Growth in the first quarter and fourth quarter of 2007 also were revised lower.

(b)Separately, the Labor Department said that initial claims for unemployment benefits jumped up 44,000 to 448,000 in the week ended July 26, the highest level in five years.

↓

1.美國失業、經濟成長及通貨膨脹持續惡化,造成消費者實質所得、購買力及消費支出每下愈況;

↓

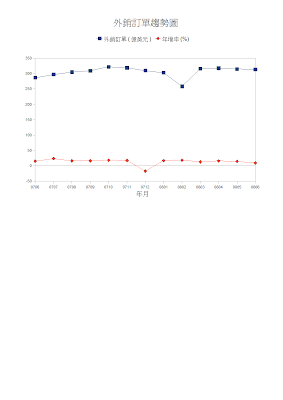

2台灣的外銷訂單趨勢每下愈況;

↓

3.台灣廠商訂單、營收獲利趨勢持續惡化;

↓

4.台灣股市籠罩在熊市前沿的暴風圈裡,暴跌、大幅振盪不斷;

↓

台灣股市:

The U.S. Labor Department July employment report:

In July, U.S. continued to reduce employment opportunities, the unemployment rate rose significantly. I'd believe that

US's actual situation of the job market is more worse than the data shows. It's an important issue that how to

increase employment is the Democratic Party and the Republican Party presidential candidate for voters.

The U.S. Labor Department July employment report that jobs of the government increased this month, but the jobs of private sector plunged. Overall, the U.S. economy got a net loss of 51,000 jobs, same level to June, but the unemployment rate increasedfrom 5.5% to 5.7%.

The actual unemployment rate's above 10.3 % worse than data shows:

The U.S.unemployment rate data do not reflect the actual employment situation. The real situation's even worse than the data show. The adults have been continuing to increase, who choose to abandon efforts to find a job since President Bush took office. If the ratio of these people over the proportion remains in the Bush came to power, the unemployment rate is not 5.7 %, but 7.1 %.

The actual unemployment rate is higher, as the calculation of the actual unemployment rate has made the following explanation: In the just-published July employment report, 19.1% of the unemployed have been unemployed for over six months. The ratio of one person over every five personal has been unemployed for a long time. the unemployment rate data cover up the seriousness of the unemployment problem. There is another point to the problem that is not completely of employment. Although there are many people working, but working hours to less than eight hours a day. They certainly have not been calculated into the number of unemployed people, but their employment is not complete. If calculate those who have given up looking for work and those who do not have full employment, the U.S. unemployment rate should be as high as 10.3 %.

Eemployment situation of the young has been continuing deterioration:

The employment of young people this year also marked deterioration.The last three months, the age of 16-year-old to 24-year-old young people can not find a significant increase in the number of work. Every summer, millions of young people are entering the job market. This year the number of the group same to last year, but fewer people found job. In May to July, the 16-year-old to 19 years of age, the unemployment rate is 19 %, while at the same time last year, the unemployment rate is 15 %. In the age group 20 to 24-year-old young man , the unemployment rate is 10 %, and 8% for the same period last year.

The reason of employment recession :

The U.S. serious unemployment = F( China).(Note: the reasons why...)

In the current increasingly intense time, the problem of employment has become very sensitive. In the past seven months, the U.S. job market has lost about 500,000 jobs. It is natural to ask, what's the reasons cause the resulting in the employment recession? briefing of the reasons attributed to economic weakness. Of course, the employment data reflects economic growth weak position from earlier this year to the end of last year . the number of jobs reduce less than expected, but still declining, this is a reflection of weakness in the job market. Rise in the unemployment rate is the same , As long as the lower rate of economic growth, that the unemployment rate and employment data will also be reflected.

Those who support for Democratic presidential candidate Obama, said: since 2000, we have seen minus effects of this tax cut policy that for the rich to achieve increased employment. President Bush got to do implementation of the policy of the rich tax cut plan. The results, we see the worst unemployment record. Republican presidential candidate John McCain is still said to inherit Bush's tax cut policies, the result will be is self-evident. In my view, has proved a failure with the policy compared to Democratic presidential candidate Obama proposed tax cuts for the poor and the rich tax increase policy is to have the opportunity to achieve success of presidential election campaign.

How to increasing jobs, revitalize the U.S. economy:

To increasing employment, revitalize the U.S. economy, the new policy that must first adjust the economic structure of the United States, to adjust the trade relations with China and reduce the dependence on foreign energy. Otherwise, it will be difficult to the U.S. economy out of a weak state.